The Component Cost of Capital Is Best Described as

Kn D1Po - F g The cost of issuing preferred stock by a corporation must be adjusted to an after-tax figure because of the 70 percent dividend exclusion provision for corporations holding other corporations preferred stock. If investors expected a rate of return of 10 in order to purchase shares the firms cost of capital would be the same as its cost of equity.

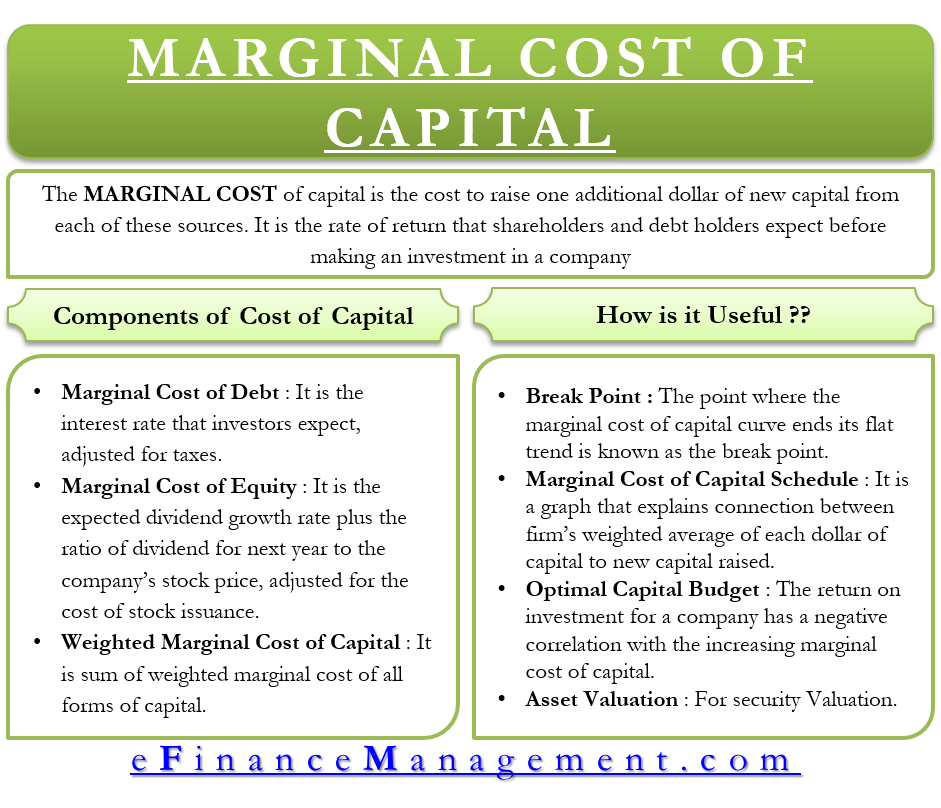

Marginal Cost Of Capital Meaning Uses And More

R0 Return at zero risk level Premium for business risk Premium for finance risk.

. It is documented in theoretical studies that cost of capital is based on some assumptions which are directly related while calculating and measuring the cost of capital. Computation of Specific Cost of Capital. 1 Cost of capital can best be defined as.

A firms capital structure can be a tricky endeavor. The three components of cost of capital are. In other words the cost of capital determines the rate of return required to persuade investors to finance a capital budgeting project.

The component cost of capital is best described as. The company s marginal tax rate is 40 percent. Assuming these two types of capital in the capital structure ie.

How to Calculate of Cost of Capital. The same would be true if the company only. View Accounting for Investments in Associates 1doc from FIN MISC at Strayer University.

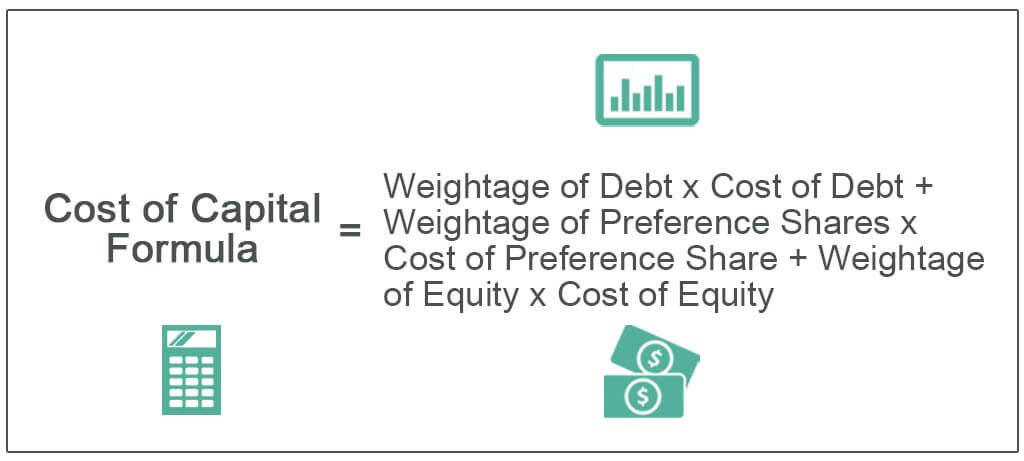

In calculating the cost of capital the following methods can be used. Cost of Capital Cost of Debt Preferred Stock Retained Earnings Equity Stock Weighted Average Cost of Capital and Return on Capital. The firms cost of capital is a weighted average of the return investors require for each of these components.

Compensation demanded by the investor in. Cost of capital provided by a given creditor or stockholderd. Tax component costs for a company.

The Cost of Debt. The cost of equity capital for a new common stock issue can best be described as. Cost of capital provided by a given creditor or stockholder.

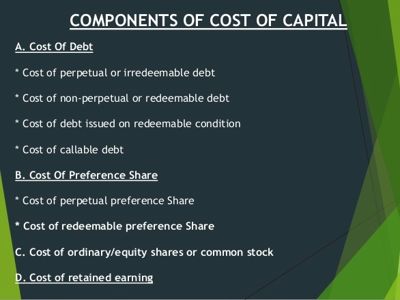

The following are the components of cost of capital. Thus a firms cost of capital may be defined as the rate of return the firm requires from investment in order to increase the value of the firm in the market place. The component costs of capital are market-determined variables in the sense that they are based on investors required returns.

K Cost of Capital. The cost of each component of capital is known as specific cost of capital. Capital component Book Value 000 Market Value 000 Component cost Debt.

Specific cost of capital is the cost of equity share capital cost of preference share capital cost of debentures etc individually. There are three basic concepts. Assumption of Cost of Capital.

Cost of capital is an important factor in determining the companys capital structure. The three components of cost of capital discussed above can be written in an equation as follows. A company s optimal capital budget is best described as the amount of new capital required to undertake all projects with an internal rate of return greater than the.

Treasury bills are currently yielding 35 the expected market return is 10 and the firm s beta is 150. These items are found in the liability side of the firms balance sheet and are called capital components. Cost of capital is a companys calculation of the minimum return that would be necessary in order to justify undertaking a capital budgeting.

Cost of capital refers to the return a company expects on a specific investment to make it worth the expenditure of resources. The component cost of capital is best described as. Cost of Capital and Capital Structure.

WACC as the term itself suggests is the weighted average of all types of capital present in the capital structure of a company. Cost of capital issued by a creditor b. Determined by interest charged.

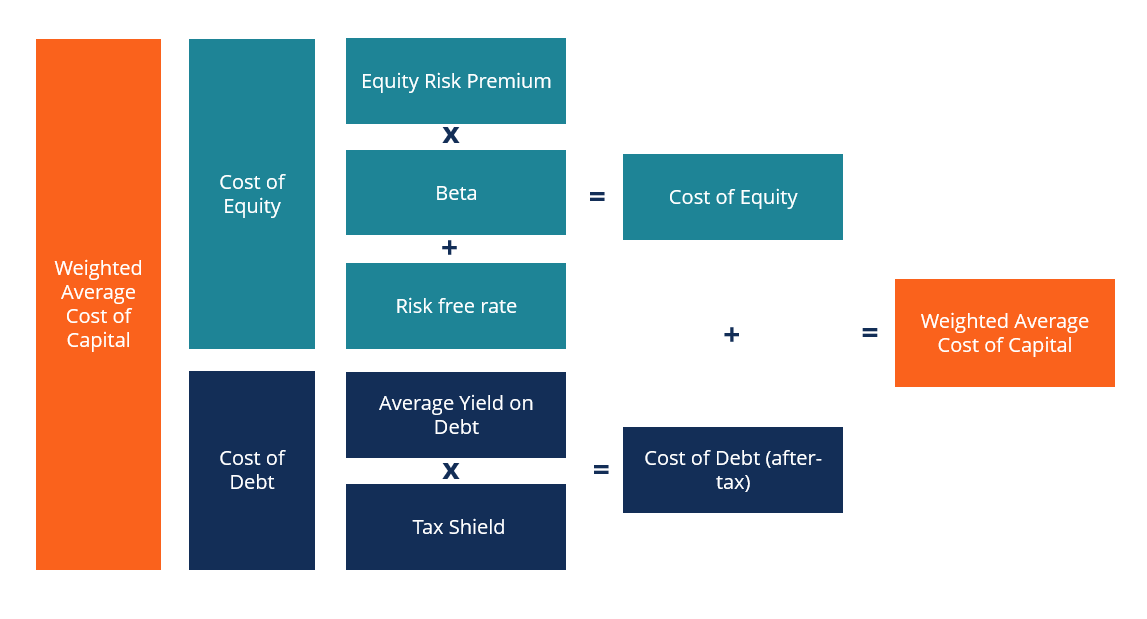

So the cost of capital is also known as the firms weighted average cost of capital or WACC. Determined by interest charged. You are free to use this image on your website templates etc Please provide us with an attribution link.

A firm raises capital from different sources such as equity preference debentures etc. Equity and debt we can calculate the WACC the following formula. Cost of capital issued by a creditor.

Compensation demanded by the investor of a firm after taxes and transaction costs are considered If a firm finances a new project entirely with debt capital but has debt and equity in its optimal capital structure it should. WACC Weight of Equity Cost of Equity Weight of Debt Cost of Debt. The component cost of capital is best described as.

Cost of capital can best be described as the ability to cover both asset and liability expenditures while generating a profit. It is not a cost as such. It is merely a hurdle rate.

It is represented as Cost of Capital Weightage of Debt Cost of Debt Weightage of Preference Shares Cost of Preference Share Weightage of Equity Cost of Equity. Cost of capital provided by a given creditor or stockholder All else equal a firm with low levels of debt may prefer debt financing because. For a firm capital consists of debt preferred stock and common stock.

Cost of capital demanded by the stockholder c. The cost of capital is heavily dependent on the type of financing used in the business. The before-tax cost of debt which is lower than the after-tax cost is used as the component cost of debt for purposes of developing the firms WACC.

A simpler cost of capital definition. Determining a companys optimal capital structure Capital Structure Capital structure refers to the amount of debt andor equity employed by a firm to fund its operations and finance its assets. Debt financing is one of the more frequently sought forms because it is one of the least costly.

It is the minimum rate of return. Cost of capital can best be defined as. Debt may be issued at par at premium or discount.

It may be perpetual or redeemable. Companies can use this rate of return to decide whether to move forward with a project. Cost of capital demanded by the stockholder.

Cost Of Capital Formula Step By Step Calculation Examples

Cost Of Capital Concept Types Rajras

Cost Of Capital Learn How Cost Of Capital Affect Capital Structure

No comments for "The Component Cost of Capital Is Best Described as"

Post a Comment